Are you overwhelmed by mounting debts and struggling to keep your business from drifting? When conventional recovery methods fail to deliver, liquidation might just be the strategic lifeline you need. Exploring various financial resources can play a crucial role in addressing immediate needs. Discovering these resources can provide additional support as you navigate the decision to liquidate.

This article delves into why liquidation could be the best solution for your company and how it offers a structured path to resolution.

The Strategic Advantages of Liquidation

Liquidation often carries a negative connotation, but it can provide significant strategic benefits for companies in severe financial distress.

Immediate Debt Relief

One of the primary advantages of liquidation is its ability to swiftly resolve outstanding debts. This immediate relief halts the accumulation of interest and penalties, offering a lifeline to businesses overwhelmed by financial obligations. When companies face insurmountable financial difficulties, liquidation can sometimes be the best course of action to settle debts and close operations responsibly.

In cities like Toronto, where the business landscape is highly competitive, struggling companies may find that selling off assets through liquidation allows them to reduce liabilities and provide some return to creditors. For businesses looking to offload office equipment and furniture, an office liquidation toronto service can simplify the process, helping businesses quickly sell off office equipment and furniture to recover value and minimize overall losses.

Controlled Exit Strategy

Liquidation allows these companies to exit the market in an orderly fashion. It follows that the ability to control is very important in preserving value and reducing losses. A business through careful planning, picks which of its assets to sell and how soon, possibly at its most valuable time.

Reputation Management

Contrary to popular opinion, the liquidation process may be less harmful to an enterprise’s reputation compared to a protracted financial fight. A clean and transparent liquidation process is responsible and may save the future reputation of the business owners and management team.

How Liquidation Serves Asset Recovery

Asset recovery is an important aspect of the whole liquidation process and can be done through specialized services.

Maximizing Asset Value

Professional inventory liquidation services will help a company attain better financial returns on its assets, something that may not be possible with hurried sales. Experts understand market dynamics and how to time sales to maximize asset value.

Smoother Operations

This process also shields companies from the complexities and costs associated with the maintenance of operations while in a state of financial distress. In addition, such asset sale-focused approaches can induce more efficiency in the utilization of resources and better outcomes for the stakeholders.

Restoring Investor Confidence

The restoration of investors’ and creditors’ confidence can be brought about by a transparent liquidation process. It is indicative of a willingness to confront financial problems openly trait that, in itself, may be viewed more positively than efforts to disguise or play down such problems.

Liquidation vs Other Restructuring Alternatives

The effectiveness of liquidation must be put in contrast to other available financial alternatives.

Liquidation vs. Bankruptcy

While liquidation and bankruptcy both lead to the individual or company being relieved from debts, liquidation is often much more simplistic. Bankruptcy proceedings can be lengthy and complex, potentially incurring additional costs. In contrast, liquidation is faster and more straightforward. It resolves financial issues much quicker and gets the matter out of the way.

Liquidation vs. Debt Restructuring

Debt restructuring permits companies to continue operating, either by extending their schedule or decreasing the amount owed. However, liquidation offers a clean finish for companies whose models are obsolete or have simply grown too great of a financial burden. It provides closure and lets stakeholders move on rather than continue to perpetuate something that cannot survive.

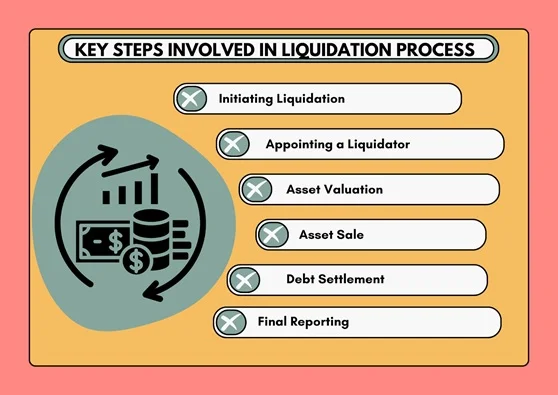

The Liquidation Process: Key Steps and Considerations

Understanding the liquidation process is essential for businesses considering this option. Here’s an overview of the key steps involved:

- Initiating Liquidation: Decide to liquidate and choose between voluntary and compulsory liquidation.

- Appointing a Liquidator: A professional liquidator is appointed to oversee the process and ensure compliance with legal requirements.

- Asset Valuation: Assess all company assets to determine their market value.

- Asset Sale: The liquidator manages asset sales, including office furniture and equipment.

- Debt Settlement: Use proceeds from asset sales to settle debts according to legal priorities.

- Final Reporting: The liquidator prepares a final report detailing the liquidation process and outcomes.

The Effects of Liquidation on Stakeholders

Liquidation impacts a variety of stakeholders in several ways, and understanding the ways that it does is crucial for successfully managing any liquidation process.

Impact on Employees

The most immediate consequence for employees could be the loss of their jobs. A well-managed liquidation process may provide severance packages and even placement services that would cushion the blow to workers.

Impact on Creditors

They may be paid part of their outstanding debt from liquidation. Of course, not all money would be returned; however, in an orderly liquidation, the amount received would be more than in financial uncertainty.

Customers and Suppliers

Customers may face inconvenience, while suppliers may lose a client but recover some payments through liquidation. The supplier may lose a customer but can recover part of the outstanding payments through liquidation.

Real-World Examples of Successful Liquidations

When considering liquidation as a viable option for resolving financial difficulties, looking at real-world examples can provide valuable insights. Here, we explore two notable cases of successful liquidations that demonstrate how this process can effectively address financial challenges and pave the way for future opportunities.

Liquidation of Moser Baer India Limited (MBIL)

Moser Baer India Limited (MBIL), a prominent player in the optical storage industry, faced significant financial difficulties due to a rapidly changing market landscape and increasing debt. In 2018, the company decided to undergo liquidation.

Why This Liquidation Was Effective:

- Asset Recovery: MBIL’s liquidation involved selling valuable assets like manufacturing facilities and patents, and recovering significant financial returns.

- Controlled Exit: The structured approach minimized disruption and preserved value.

- Reputation Management: Transparent handling maintained a positive reputation among stakeholders.

Liquidation of SR Foils & Tissue Limited (SRFTL)

S R Foils & Tissue Limited (SRFTL), a company specializing in foils and tissue products, encountered financial difficulties due to market conditions and operational challenges. In 2021, SRFTL opted for liquidation to address its financial instability.

Why This Liquidation Was Effective:

- Maximized Asset Value: SRFTL focused on valuing and selling its production equipment and inventory, achieving better financial returns.

- Efficient Process: The streamlined liquidation process reduced the impact on employees and stakeholders.

- Investor Confidence: Transparency in the process restored confidence among investors and creditors.

These examples illustrate that liquidation when executed effectively, can resolve financial issues, recover asset value, and protect a company’s reputation.

Conclusion

In the face of financial challenges, liquidation can be a strategic lifeline, offering a clear path to resolution. By understanding and utilizing the benefits of liquidation and specialized services, businesses can navigate their financial difficulties with greater confidence and emerge with a renewed financial outlook.

FAQs

1. How long does the liquidation process usually take?

The length of the liquidation process can range from several months in simple liquidations to over one year in the more complex ones, depending on the size and complexity of the business concerned.

2. Does the company continue to operate during the liquidation process?

Sometimes, especially when necessary for realizing assets or completing current contracts, but normally this is under the appointed liquidator’s supervision.

3. What happens to intellectual property in case of liquidation?

As far as liquidation goes, it would be treated as an asset, like a patent or trademark, and would be sold off. The proceeds that come in through such sales would accrue to the creditors in priorities as laid down by law.

For more related information, explore further by clicking here.