Bitcoin reached a new peak on November 6, fueled by investor optimism viewing President-elect Donald Trump’s victory as a potential catalyst for the cryptocurrency market.

In early trading, Bitcoin surged by 8%, setting a fresh all-time high above $76,000, surpassing its previous record from March.

Other prominent cryptocurrencies joined this rally, showcasing the strength and volatility in cryptocurrency trading. Ethereum, the second-largest cryptocurrency, surpassing $2900. Dogecoin, frequently mentioned by Elon Musk, a known Trump supporter, spiked by over 50%.

Supporters of Trump’s policies on deregulation, tax cuts, and a move away from centralized financial bodies like the Federal Reserve see these elements as potential opportunities for cryptocurrency trading growth. Many believe this favorable stance has contributed to recent market enthusiasm.

What Might Crypto Investors Expect During Trump’s Presidency?

Here’s a look at Trump’s current approach to cryptocurrency and what it could mean for the markets moving forward.

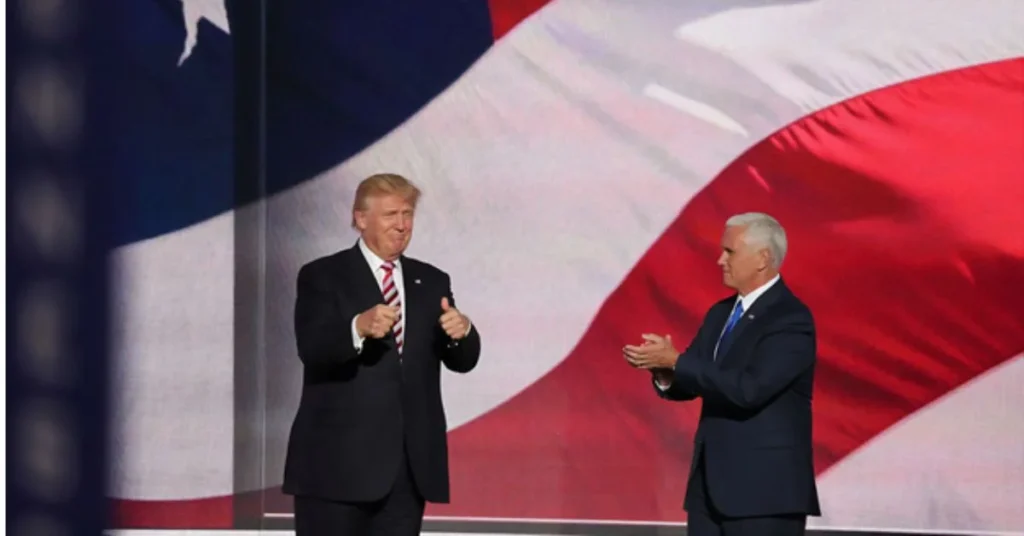

Historically skeptical of cryptocurrency, Trump has presented himself in 2024 as a pro-crypto candidate. This marks a significant shift from his prior presidency, during which he voiced concerns about cryptocurrency’s potential for misuse and supported regulatory measures, including the SEC’s high-profile lawsuit against Ripple.

This year, however, Trump actively reached out to cryptocurrency advocates and donors. In July, at a major crypto conference in Nashville, he stated his ambition for the U.S. to become a “crypto capital” and “Bitcoin superpower.” Throughout the campaign, Trump accepted Bitcoin donations, and in September, he even made headlines for using Bitcoin for a payment in New York City.

At the Bitcoin 2024 conference, Trump outlined a set of crypto-friendly proposals, suggesting that Bitcoin’s value could flourish under his administration. His main proposals include:

- Establishing a Government Bitcoin Reserve: Trump proposed retaining any Bitcoin currently held or acquired by the U.S. government, suggesting it could become part of a strategic national reserve. While the government reportedly held over $5 billion in Bitcoin as of late 2023, it remains uncertain how this reserve would be utilized or received within the broader crypto industry.

- Forming a Crypto Advisory Council: Trump proposed creating a “Bitcoin and Crypto Presidential Advisory Council” to develop industry-friendly guidelines.

- Preventing the Federal Reserve from Issuing Digital Currency: Trump has consistently opposed the concept of a central bank digital currency (CBDC), describing it as a potential threat to individual freedom. This opposition aligns with broader skepticism within U.S. cryptocurrency circles. In May, the House passed a bill prohibiting the Federal Reserve from creating a CBDC.

What Could a Trump Presidency Mean for Crypto?

Some within the cryptocurrency community view Trump’s presidency as a possible step toward clearer regulatory frameworks. For instance, Analysts suggest that this administration could help streamline stablecoin regulations, potentially expanding blockchain usage for transactions. They also anticipate that regulatory clarity may reduce the barriers for launching certain crypto projects.

Trump has also expressed a desire to replace Gary Gensler, the current SEC chair, which could mark a shift in regulatory attitudes toward the crypto industry.

However, questions regarding ethical concerns have emerged. Trump recently launched a decentralized finance (DeFi) venture, World Liberty Financial, which includes a cryptocurrency known as $WLFI. This project was announced just weeks before the election, raising potential conflicts of interest. With Trump’s direct financial stake in this venture, there are concerns about the overlap between his role in regulation and his business interests in the crypto market.

Conclusion

Trump’s evolving stance on digital assets could open doors for a less restrictive regulatory environment, which may appeal to investors and crypto advocates. However, his involvement in the cryptocurrency sector through World Liberty Financial might heighten ethical scrutiny, especially as he assumes office.

If you find this article exciting, click here for more.