Have you ever felt overwhelmed and at a loss as to what to do right after an accident? Are you wondering how much your insurance company will cover and how to effectively start filing a claim? Knowing your insurance coverage can be instrumental in helping you out of such a stressful situation.

Why is it then that understanding the finer details of your policy becomes very critical, especially in the event of an accident? How does this kind of knowledge affect your financial stability and your peace of mind?

Let’s explore key reasons why knowing your insurance coverage is essential when facing the unexpected.

1. Handle the Claims Process

Understanding your insurance coverage is crucial after an accident for several reasons. First, it helps you navigate the claims process efficiently. Knowing the details of your policy, including the limits, deductibles, and types of coverage, allows you to determine what expenses and damages are covered.

Additionally, understanding your coverage can prevent surprises and ensure that you receive the full benefits to which you’re entitled. By being informed, you can make more informed decisions, potentially avoid costly mistakes, and work effectively with your insurance company to resolve your claim.

For example, in regions like Virginia Beach, where accidents can have significant impacts, having a clear grasp of your policy details helps you manage medical expenses, property damage, and other costs effectively. Consulting with a virginia beach personal injury lawyer can further enhance your understanding, as they can provide expert advice to your specific situation.

2. Checking on Sufficient Coverage

One of the major reasons you should know your insurance coverage is to ensure that you have adequate protection. Insurance policies are very different in terms of coverage limits, deductibles, and exclusions. Knowing what is covered will help you assess whether the protection is enough for your needs.

For example, if you are involved in an accident in Virginia, knowing how your auto insurance policy specifies liability limits, collision coverage, and personal injury protection will help you determine whether you have sufficient coverage for property damage, medical care, and other expenses.

Especially, if you want to know what kind of coverage you have in Virginia, which follows a “fault” insurance system. Should you be deemed at fault in an accident, you’ll very likely be paying for those damages. And unless you understand your policy very well, you could be surprised by out-of-pocket expenses that could prove financially crippling, especially given Virginia’s unique legal and insurance requirements.

3. Manage the Financial Ramifications

Accidents may lead to heavy financial consequences in the form of repair costs, medical expenses, and possible litigation costs. Such knowledge of insurance coverage makes one more able to handle these financial aspects better. It also helps one to assess how much of it will have to be paid out of pocket, allowing for better preparation and avoiding financial shocks.

For instance, if your health insurance partially covers medical expenses in the event of an accident, knowing the extent to which you are covered will help you manage the cost of healthcare. Similarly, you can set money aside for the repair or replacement of your vehicle by being aware of the extent of coverage offered by your auto insurance.

4. Coverage Gap Prevention

Many policies exclude or limit coverage in such a way as to leave one with a coverage gap. Coverage gaps expose you to financial risks because certain aspects of the situation are not covered by your policy. Knowing what you are covered with the help of a car accident personal injury lawyer will help you bring attention to areas that may create gaps in protection.

For example, some auto insurance policies do not cover a rental car while your vehicle is in the shop being repaired. Knowing this beforehand allows one to make alternative arrangements or expand a policy to accommodate such an event.

5. Protecting Your Legal Rights

Some accidents may lead to legal claims or lawsuits. Consulting with a personal injury lawyer about your insurance policy can help protect your legal rights and ensure proper representation. Most policies include legal protection or attorney fee coverage if you get sued.

Knowing the legal provisions in your policy can help you make a well-informed decision concerning legal representation and make sure you are adequately represented should your case go to court. Such knowledge may also turn out to be very useful in making you knowledgeable about your different responsibilities and rights as a policyholder.

6. Evaluating Policy Limits and Deductibles

The limits and deductibles on insurance policies may impact the amount you are going to pay out of pocket and precisely the real level of your coverage. Hence, comprehension of these limits and deductibles is critical for affecting financial planning and expectations management.

For instance, if your policy has a very high deductible, you must pay a decent amount of money before your insurance coverage starts to kick in. That way, it will keep you on your toes and planning your expenditure ahead of time, thus avoiding shocking financial stress. Again, this knowledge from a car accident lawyer of policy limits can give you an idea of just how much is covered by your insurance for various kinds of claims.

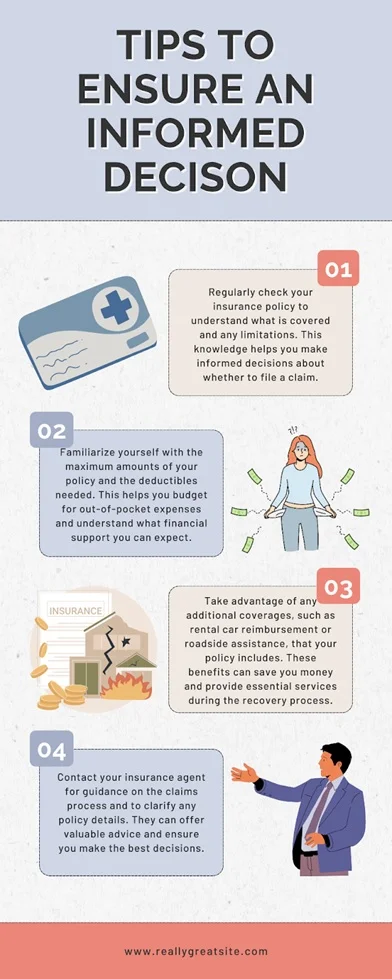

7. Making Informed Decisions

Knowing what is and isn’t covered by your insurance policy may help you to make informed decisions immediately after an accident. Be it deciding whether to file a claim, how to proceed with the repairs, or even how to manage your medical treatment, your knowledge of the policy allows you to make choices that best fit your coverage and financial situation.

For example, knowing you have rental car coverage through your auto insurance means you can rent a vehicle while yours is in the repair shop without incurring added expenses. Similarly, knowing what your health insurance has to offer allows you to choose the best feasible doctors and treatments that suit your needs best.

Typical Documents Required for Filing a Claim

| Document Type | Description | Purpose |

| Accident Report | Official report filed by law enforcement or witnesses | Provides a detailed account of the accident |

| Medical Bills | Itemized bills from healthcare providers | Documents the medical expenses incurred due to the accident |

| Repair Estimates | Quotes from mechanics or repair shops | Details the cost of repairing property damage |

| Proof of Insurance | Copy of your insurance policy and ID card | Verifies your coverage and policy details |

| Photographs | Photos of the accident scene, injuries, and damages | Visual evidence to support your claim |

| Witness Statements | Written or recorded statements from witnesses | Corroborates your account of the accident |

| Medical Records | Detailed health records and treatment history | Supports claims related to injury and medical treatment |

Conclusion

One of the critical aspects of dealing with a mishap is understanding your insurance coverage. Knowing the terms, limits, and exclusions of your policy is very important to ensure appropriate coverage, easily go through a claim, and deal with all the financial results of an accident.

You will be able to make appropriate decisions, avoid gaps in coverage, and protect your legal rights because you have such information. Knowing what your insurance covers will help you deal with these unexpected events at a foundational level, guaranteeing both effective and comprehensive care that keeps one well-prepared in the face of such challenges.

FAQs

Why is it important to understand my insurance coverage after an accident?

Understanding your insurance coverage ensures you are aware of what is covered, helps you avoid unexpected expenses, and streamlines the claims process.

How can knowing my policy details impact my financial stability?

It helps you anticipate out-of-pocket costs, plan for any financial responsibilities, and avoid surprises that could strain your finances.

What should I know about my auto insurance policy if I’m in an accident in Virginia?

Be aware of your liability limits, collision coverage, personal injury protection, and Virginia’s fault-based insurance system.

For more information click here.