Imagine celebrating birthdays, graduations, and anniversaries without the weight of debt holding you back. Debt can quietly creep into your life, affecting your stress levels and your ability to enjoy family milestones. For many, it feels like an unending cycle of stress that overshadows family milestones. Freeing yourself from debt, however, can open the door to more fulfilling experiences. This article outlines five action-oriented steps to help you get out of debt and focus on what truly matters—your family.

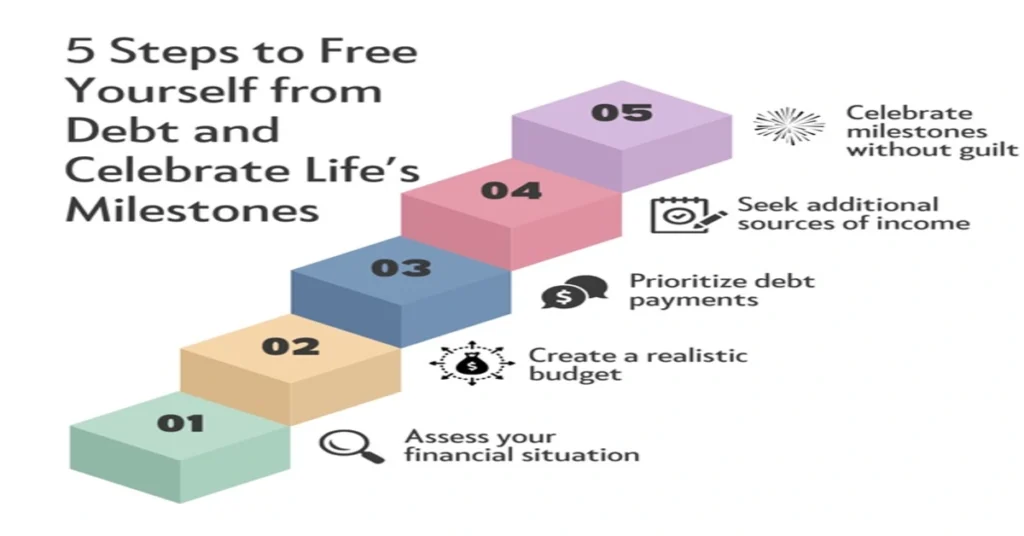

Step 1: Assess Your Financial Situation

Before you can be relieved of debt, you will need to understand your finances. Start by taking inventory of your income, expenses, and debts to get a clear picture of where you stand.

Assess Income and Expenses

List all sources of income—salary, part-time jobs, and passive income—to establish a clear picture of your monthly earnings.

Start tracking the expenses. Create an entire monthly expense list and include both fixed and variable. List these as being either of those types: Fixed, the rent or mortgage, utilities, and insurance, along with other categories. Variable-type expenses are those of groceries, entertainment, and going to a restaurant. Tracking these expenses reveals where your money goes and highlights areas where you can cut back.

Understanding Your Debt

After identifying your income and expenses, review your debts. For each debt, note its interest rate and minimum monthly payment. You may be surprised at the debts you have forgotten. If you discover a debt owed to Midland Credit Management while reviewing your financial situation, it can be helpful to understand their role and your options for handling the debt.

Also, being aware of any midland credit management class action lawsuit may provide insight into your options if you believe the company’s practices have impacted you. Contacting the company to confirm the legitimacy of debt and exploring repayment options that align with your financial situation is a good approach. You can also use a debt calculator to estimate how many years it will take for you to pay off the loan using your current level of payments. Knowing this amount is a great motivator to make the needed changes.

Step 2: Create a Realistic Budget

After reviewing your financial status, the next step is building a realistic budget. Your budget serves as a roadmap, guiding how you spend and helping you set financial goals.

Setting Financial Goals

Begin by establishing short-term and long-term financial goals. Short-term objectives can include paying off a credit card or saving money for a family outing, while long-term objectives can include saving money for your child’s education or planning a family vacation.

Implementing the Budget

Now you’ll need to implement your budget after determining your financial objectives. Now you’ll assign specific sums to each category according to your income and priorities. Be realistic about what you can accomplish each month.

Monitor Spending

Consider using budgeting apps or spreadsheets to consistently monitor expenses. With this, you would quickly know which areas to trim down or cut back on for the sake of minimizing wasteful spending. Remember that your spending habits have to adjust to priorities, especially with family milestones and paying debt.

Step 3: Prioritize Debt Payments

Now that you have created a budget, it’s time to prioritize your debt payments. Not all debts are alike, so knowing which to pay off first is essential.

Identify Types of Debt

Distinguish between high-interest and low-interest debts. High-interest debts, such as credit cards, can cost you much more over time. Lower-interest debts, such as student loans, may take longer to pay off but won’t accumulate interest as quickly.

Strategies for Payment

There are two popular methods for debt repayment: the snowball method and the avalanche method.

- Snowball method: The snowball method is the payment strategy where you pay the smallest debt first. When that is paid off, then to the next smallest one, and so on. This method can be motivating, as it provides quick wins along the way.

- Avalanche method: Here you will focus on paying the highest interest first. Even if it takes a while for you to see, in the long run, this method saves you much in interest payments.

Choose the method that suits you best, and aim to pay more than the minimum to progress faster.

Step 4: Seek Additional Sources of Income

In addition to budget control and paying off debt in order of priority, you can speed up the way to financial freedom if you seek alternative sources of income.

Explore Side Gigs or Freelancing

More income sources may come from taking up side hustles or freelance work. If you have skills in writing, graphic design, or programming, you can find freelance opportunities that fit your schedule. Even just a few hours a week can add up in terms of financial improvement.

Selling Unused Items

Look around the house and list what you may no longer want. Selling these unwanted items can provide extra cash while helping you declutter your home. Websites like eBay, Craigslist, and Facebook Marketplace can help you sell items quickly.

Step 5: Celebrate Milestones Without Guilt

After following these steps and making progress toward financial freedom, you can begin enjoying family milestones without guilt. This is an important part of bonding the family and creating long-lasting memories.

Building a Family Fund

Set aside an account dedicated solely to family celebrations, like birthdays, anniversaries, and graduations. This money will come in handy at those specific times. That way, you will avoid having to worry about spreading around funds or the expenses for such important celebrations, which would take all the fun out of having it.

Incorporating Affordable Traditions

You don’t have to break the bank for fun memories. Incorporate low-cost traditions into your celebrations. Host a potluck for birthdays or family gatherings, where everyone brings a dish to share. This approach fosters community and allows everyone to contribute without feeling burdened by high costs.

Conclusion

Becoming debt-free is an empowering journey that enables you to focus on what truly matters—your family and the milestones that shape your lives together. Assess your financial situation, create a realistic budget, prioritize debt payments, seek additional income, and celebrate milestones without guilt, taking control of your financial future.

Break free from the cycle of debt and create a life filled with cherished moments. Start your journey to financial freedom with these steps today.

FAQs

How can I create a budget that I can stick to?

Start by tracking your spending for one month. Then, using your income and priorities, allocate money. Review and adjust this budget from time to time to stay on track with changes in your financial circumstances.

What are the most effective debt repayment strategies?

The snowball method focuses on paying off smaller debts first to gain quick wins, while the avalanche method targets high-interest debts to save on interest payments. Choose the strategy that best suits your motivation and financial goals.

How do class action lawsuits impact personal debt?

Class action lawsuits against creditors can help recover money for unfair practices. If you believe you may be eligible to join a lawsuit related to your debt, consult an attorney for guidance.

If you find this article helpful, click here for more.